Whistleblower loses right to sue IRS

The IRS Whistleblower lost his standing or right to sue the Commissioner of Internal Revenue over denying a Whistleblower claim and is jumping for joy. The Whistleblower law is unambiguous. If the claim is denied, the Whistleblower has thirty days to file a petition with the Tax Court to review the administrative procedures that the IRS used to make this determination. That is what happened, the claim was denied, and the Whistleblower filed a petition with the Tax Court.

Then the unthinkable happened the IRS reopened the claim. But that is not the end of it. The new manager at the Whistleblower Office, following the administrating procedures, sent a preliminary notice of denial. The preliminary notice allows the Whistleblower to review the administrative record and ask questions. The Whistleblower requested to see the evidence and laws used to determine the denial and asked if the IRS Chief Counsel's Office was involved. Before you could say, lickety-split, the claim was reopened.

It is important people understand why the claim was denied in the first place.

I caution you to understand that not all members of the healthcare industry practice the following tax evasion scheme.

For the past forty years, it is common for a provider to bill a privately insured patient a sizeable medical bill, then transfer the account payment to the insurance company. The insurance company then spreads these charges among its many members and collects premiums to pay for them. When it comes time to pay the patient's bill, the insurance company pays a lower amount than billed and keeps the difference. The relationship of the provider and insurance company is that of a contractor and sub-contractor wherein the provider pays the insurance company for referring patients to it. In legal terms, it is known as a kickback. The providers and insurance companies call it a contract adjustment and write it off for tax purposes. It is easy to see how the insurance company has to pay taxes on the kickbacks. Still, the providers may not realize that the kickback payments create a unique tax liability. The providers, even not-for-profit hospitals, have to pay income taxes on the illegal kickback payments.

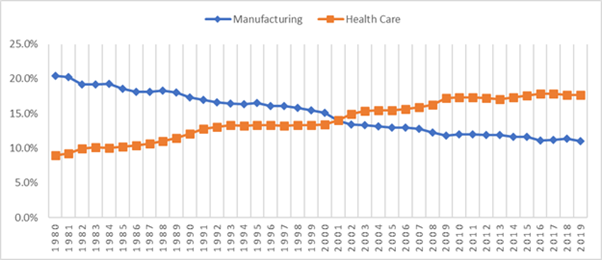

The question is whether the IRS is taking the tax evasion scheme seriously. After seeing the attached chart showing how much the Healthcare Industry has damaged the Manufacturing Industries' revenues, the executive branch is taking it seriously.

This chart illustrates the Gross Domestic Price percentages of the Manufacturing Industry and the Healthcare Industry over forty years. The graph clearly shows the direct relationship between the growth of healthcare revenues and the decrease in the Manufacturing Industry's revenues.

In the infrastructure bill, the Biden administration had requested forty billion dollars to hire 85,000 tax auditors to collect over a trillion dollars from tax cheats to pay for the infrastructure bill, but it was removed. However, a new bill just introduced, The IRS Whistleblower Program Improvement Act will allow the IRS Whistleblower Office to keep a small percentage of collected tax revenues for itself and hire more tax auditors. Where do you think, they are going to start?

Comments

Post a Comment